A Gold IRA rollover is yet another way to transfer existing retirement resources right into a precious metals IRA. A rollover occurs when an investor takes money from an current retirement account and rolls them into a new account.

Particular assumptions may perhaps have already been built in reference to the Assessment introduced herein, so changes to assumptions may have a material influence on the conclusions or statements built on this site. Earlier performance is just not indicative of upcoming final results. Web-site material shall not be construed being a recommendation to buy or provide any security, fiscal instrument, physical metal, or to get involved in any unique trading or investment system. Any action that you choose to just take Because of this of data, Evaluation, or ad on this site is your accountability. Speak to your Expert advisers prior to making any conclusions.

As a result of the nature of bonds, component of this return calculation is unrealized. You will find dangers to leasing and loaning your precious metals, and all returns are topic to lessee, sublessee, and borrower overall performance. Past overall performance is no assurance of long term benefits.

It’s important for you to know the company you’re opening an account with. We are committed to honest and clear communication with our purchasers. The info furnished underneath can be a substantial-degree overview of our item choices, so you can her latest blog obtain to find out us far better.

Buying a Gold IRA is an excellent way to shield your retirement money from inflation and sector volatility. Not like traditional paper assets, physical gold and other precious metals Use a tangible value that tends to extend in occasions of economic uncertainty.

As the money sector gets to be a lot more unpredictable, traders are progressively turning to alternative investment possibilities like a Gold IRA to safeguard their retirement money.

Traders can convert their existing IRA or 401(k) view it now right into a Gold IRA by finishing a gold IRA conversion. The conversion approach is comparable into a transfer or rollover and permits investors to carry physical gold and other precious metals inside Visit This Link of a tax-advantaged retirement account.

• Buying gold can provide portfolio diversification and protection from inflationary pressures.

Traders can transfer their current IRA or 401(k) right into a Gold IRA by completing a gold IRA transfer. The transfer process is simple and usually usually takes several months to accomplish.

You will discover dangers to leasing your precious metals, and all quoted premiums are subject to lessee, and sublessee functionality. Past performance isn't any guarantee of foreseeable future success.

• With the ideal custodian, buyers should buy physical gold bars or coins to retailer in their retirement accounts for an easy IRA transfer to gold.

A Gold IRA is actually a type of Specific Retirement Account (IRA) that allows traders to carry physical gold as well as other precious metals inside of a tax-advantaged retirement account.

• Precious metals like gold are tangible assets which were used being a method of forex during record.

The best gold IRA companies provide clientele the opportunity to hold a variety of precious metals, together with silver, within their IRA account. Keeping silver in a precious metals IRA might help investors diversify their portfolio and shield their retirement funds from market volatility.

Investors get only the highest high-quality gold and silver coins, made available at competitive price ranges with one hundred% customer pleasure guaranteed.

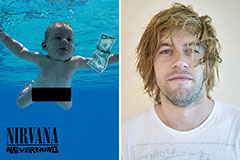

Spencer Elden Then & Now!

Spencer Elden Then & Now! Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!